Services

ServicesGST Registration services to individuals and businesses in India. With their expert knowledge of the Goods and Services Tax (GST) laws, they make the GST Registration process quick, easy, and hassle-free.

Inquiry Now

Satisfied Clients

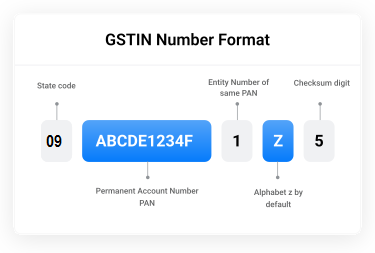

GST registration is the process where a business gets a unique GSTIN (Goods and Services Tax Identification Number) to comply with the GST laws in India. Businesses with an annual turnover above ₹40 lakh (₹20 lakh for some states) must register for GST, as per the GST Act of 2017. The GSTIN is a 15-digit unique number that identifies taxpayers and helps track transactions under the GST system.

GST (Goods and Services Tax) is a nationwide indirect tax replacing older taxes like VAT and excise duty. Businesses involved in selling online, regardless of turnover, also need to register.

GST registration is quick and easy via the official GST portal, eliminating the need for physical visits to government offices. After submitting your application, you’ll receive an ARN (Application Reference Number) to track the status of your registration online.

Ensure compliance and enjoy benefits like input tax credit by completing your GST registration today!

Interstate trading is impossible without having a GST number. It is possible only after registering the business under GST.

You must acquire a GSTIN if you want to compete with big brands like Amazon, Flipkart, Shopify, Paytm on e-commerce platforms or through your own website.

The cascading effect means the tax on a tax system that pre-existed where the tax liability was passed on at every stage of the transaction.

Private Limited Company

Limited Liability Partnership (LLP)/ Partnership Firm

Individual/Proprietorship

Book a slot with our GST experts and resolve all your queries.

Provide the required documents and fill in essential business details such as business name, SEZ unit, Principal place of business, additional places, mobile number, email address, state, PAN card details for initiating the registration process.

Our team will file your GST registration application on the online portal. Once filed, you'll receive an OTP for verification. .

Our team will provide you with the Application Reference Number (ARN) (also called as temporary reference number) after successful verification. You can track application status using the number. GST registration certificate will be available on the official GST website after the process is completed. All the documents should be submitted within a time frame and accurate as per the government guidelines to avoid delay. The GST certificate will be delivered directly by the Central government. Vakilsearch will initiate and guide you through the process.

Step-1:

Gather all the required documents

Step-2:

Share the documents with our team

Step-3:

We will prepare the application and apply for GST Number online

Step-4:

Wait for Application to get approved

With GST RETURN FILING, you can get your GST Registration in a few simple steps. GST RETURN FILING is well-known for its user-friendly online platform with which you can avail GST Registration Services services from the comfort of your home/office. The dedicated representatives of GST RETURN FILING will be in constant touch with you right from the word go. They will collect from you all the documents required and do the needful. Contact us now for the Best GST Registration Services in India.

A GSTIN number is a 15-digit code that identifies a registered taxpayer (mainly dealers, suppliers, or any business entity across India) registered under the GST regime. GSTIN is an abbreviation for Goods and Services Tax Identification Number. This provides greater transparency in the GST system, helps in collecting all the GST-related data from the vendors, and prevents tax evasion. Having a GST number provides many advantages for small enterprises. It gives businesses access to different government assistance and relief programs, allows them to claim input tax credit on their purchases, and increases their credibility with suppliers and consumers.

The GSTIN plays a crucial role in activities such as availing loans, claiming refunds, simplifying verification processes, making corrections, and understanding one’s GST identification number.

GST registration offers businesses numerous advantages, establishing legitimacy and ensuring compliance with tax regulations:

There are no government fees for GST registration if you do it yourself on the GST portal, helping you save money. However, hiring an expert can make the process easier, reduce the chances of rejection, and ensure quick and hassle-free GST registration.

A GSTIN (Goods and Services Tax Identification Number) is a unique 15-digit alphanumeric code assigned to businesses registered under the GST system in India. Here is an example of a GSTIN:

Consult an Expert

“We help small businesses achieve big success with our comprehensive Compliance services.”